CSI Lawyer 12.1 update package 16.4.25

16. April, 2025 | Version UpdatesWe have just published a new CSI Lawyer 12.1 update package. The version fixes the following software defects reported by our customers, and brings also some new functions to bookkeeping integrations used by Swedish customers.

The software defects fixed

General

- The column filter did not follow alphabetical order e.g. in views.

Customer

- The “Matter Request” column was missing from the “Customer Identifications” folder view in the customer window.

Matter

- In the “Matters Until Today” and “Matters Until the End of the Previous Invoicing Period” views of the Billable Matters folder, the “Min. Date” columns were in wrong order.

- In the calendar, the matter view could not be sorted alphabetically by the Principal column.

Entries

- The default transaction type of the business unit was inherited to a transaction created from a timer, even though the matter in question had its own default transaction type defined.

- From the critical task calendar, a restricted user was able to open details of a critical task linked to a protected matter to which the user had no rights.

Proof invoice

- In the Swedish proof invoice, the account number always showed Bankgiro in front of it, even though the account was not necessarily a bankgiro type. After the correction, the account number is shown as is and the account number type can be written in front of it.

Preliminary invoice

- A preliminary invoice remained in the Open status if the reviewer edited the transaction text from the list view and then marked the preliminary invoice as reviewed without saving the change. After the correction, the software forces the user to either save the changes or cancel them.

- A preliminary invoice of a private customer could be approved, even though the address of the customer was blank.

Invoice

- Editing the print order of phases affected the invoice specification, even though “Show transactions by phases” was not selected in the printing parameters. NOTE: If the issue occurs on a customer’s customized invoice specification page, it must be fixed separately.

- When the invoice was created directly from the matter, the price adjustment window did not take into account expenses that had been reviewed but were not on the preliminary invoice.

- When printing an invoice using the Sweden invoice template, the bank name was not displayed if the national account number was empty.

- In certain situations, the invoice sent to Maventa was not valid due to a VAT rounding error that prevented the invoice from being sent. Maventa then issued an error message: [BR-CO-16]-Amount due for payment (BT-115) = Invoice total amount with VAT (BT-112) – Paid amount (BT-113) + Rounding amount (BT-114).

- Creating Finvoice 3.0 invoice material from a tax-free invoice crashed with the error “Object reference not set to an instance of an Object”.

Payment reminder

- When printing multiple payment reminders at once using the “Print each invoice using its own settings” option, not all invoice data fields were locked.

Reporting

- The layout of a report saved the business unit logo from the database where the layout was edited, and it was no longer able to display the new logo when printed (if the logo was changed or the report was exported to another database where the business unit had its own logo).

- Downloading the updated version of a report from the publishing service was unable to import the language translations of the report.

New functionalities in the version

Voucher lines of invoices transferred to Hogia

- When transferring invoices to Hogia, the integration creates three separate voucher lines for the balance sheet account, the sales account, and the sales account’s contra account from the expenses imported from Hogia’s balance sheet account.

Clarification of purchase VAT on expenses imported from Fortnox and Hogia

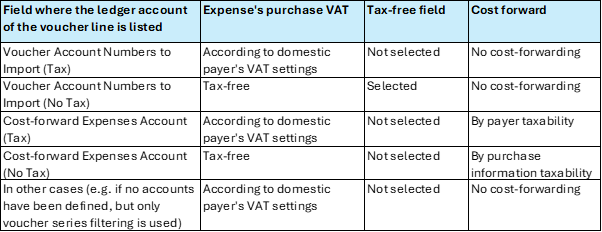

- The Fortnox and Hogia accounting systems do not provide the correct purchase VAT for expenses imported into the CSI software, so the VAT handling of expenses in productized integrations has been corrected as follows:

- The VAT base of a domestic payer is defined as follows:

- Date: Expense date, or if not available, current date

- Taxability: Taxable

- Business unit: Main business unit.